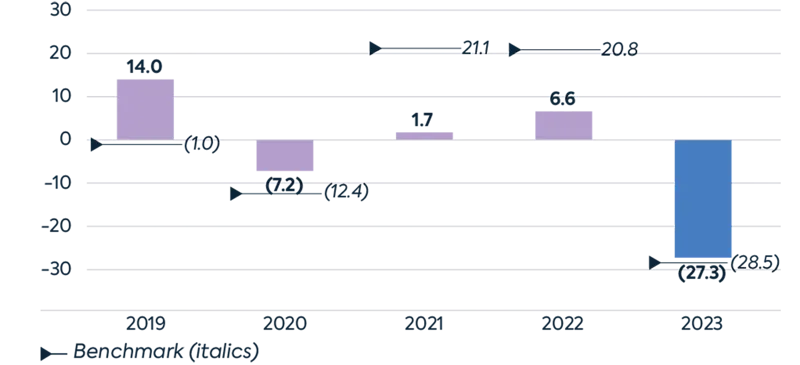

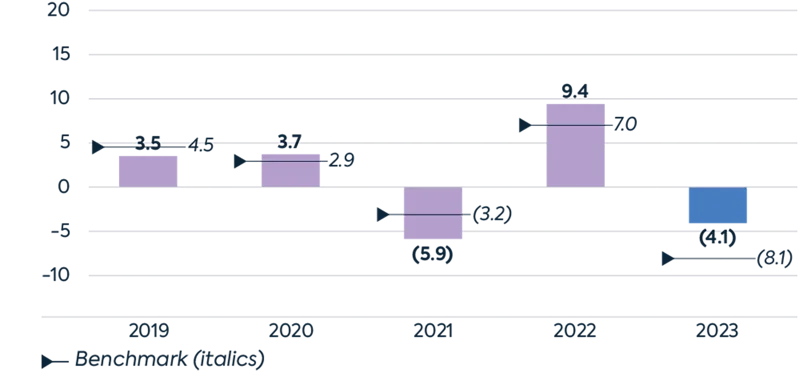

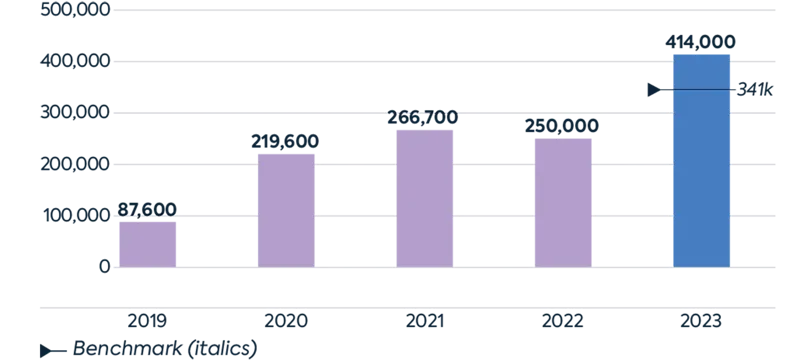

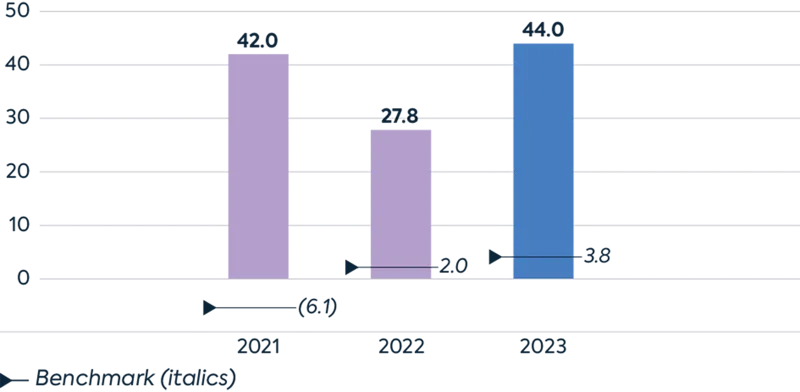

Our key performance indicators (KPIs) measure the principal metrics that we focus on to run the business, and they, along with the key measures that drive them, help determine how we are remunerated. Over the longer term, we aim to outperform our benchmarks through successfully executing our strategy. Over the last 12 months, the challenging macroeconomic environment impacted absolute property returns and real estate share prices. However, our strong operating performance helped us outperform many of our benchmarks.

Financial KPIs

Total Shareholder Return % (TSR)

Total Accounting Return % (TAR)

Total Property Return % (TPR)

Growth of committed Flex space

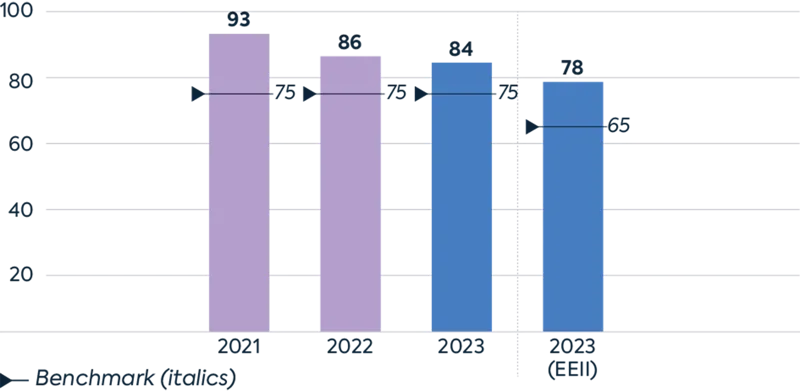

Non-Financial KPIs

Given the growing importance of sustainability, and our wider stakeholders to the success of our business, we introduced five new non-financial KPIs for 2020/21. Each of these KPIs are performance criteria for senior executive remuneration (see key below), with performance against our sustainability KPIs measured in aggregate.