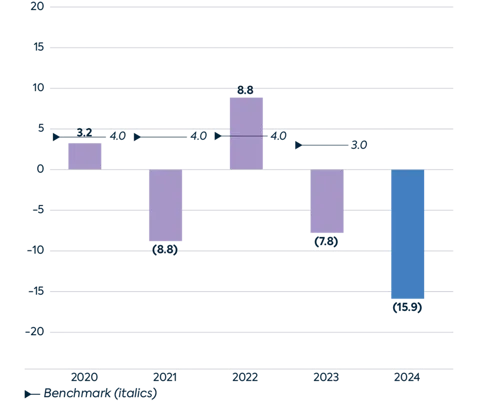

Our key performance indicators (KPIs) measure the principal metrics that we focus on to run the business, and they, along with the key measures that drive them, help determine how we are remunerated. Over the longer term, we aim to outperform our benchmarks through successfully executing our strategy. Over the last 12 months, the challenging macroeconomic environment impacted absolute property returns and real estate share prices. However, our strong operating performance helped us outperform many of our benchmarks.

Total Shareholder Return % (TSR)

Total Accounting Return % (TAR)

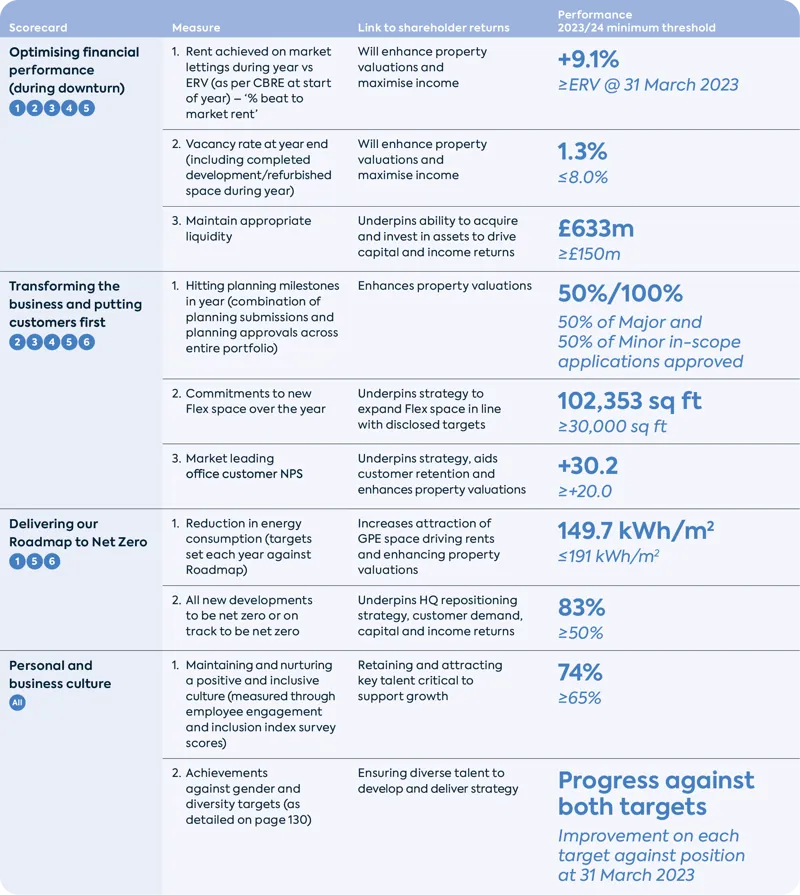

Revised KPIs for 2023/2024

As explained in last year’s Annual Report, given the macro-economic backdrop, the Group has moved to a more target-based operational scorecard under the revised Directors’ remuneration policy approved by shareholders at the 2023 Annual General Meeting. The scorecard is designed to motivate management to optimise returns for shareholders by focusing on clear and measurable objectives to deliver our strategic priorities. Each of the measures is designed to directly or indirectly drive our financial KPIs and shareholder value in the longer term and form an integral part of the revised Directors’ remuneration policy to align performance and executive remuneration.

Our KPIs are driven by our strategic priorities

1 - Progress sustainability and innovation agenda

2 - Enhance portfolio through sales and acquisitions

3 - Deliver on our Flex ambition

4 - Embed our ‘Customer First’ approach

5 - Deliver and lease the committed schemes

6 - Prepare the pipeline

All - All six priorities